Unfortunately, the article is protected by a paywall, but you can read the story here and here. In the US, Visa and Mastercard will almost certainly increase their network fees paid by merchants. While the exact details are still uncertain, it's reasonable to expect similar hikes to hit Australian retailers soon. Let's break down what this could mean for retailers.

The Potential Impact

-

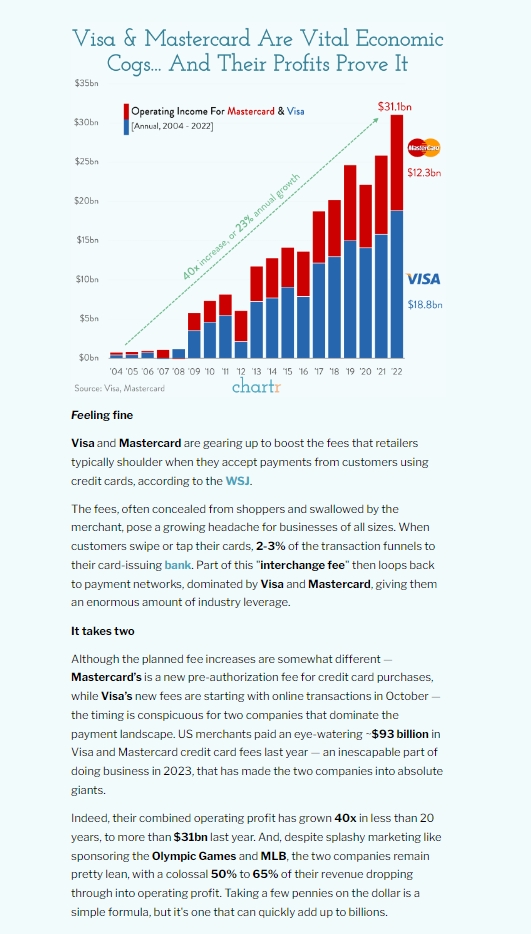

My back-of-the-envelope calculations suggest this would amount to a 0.5% increase in credit card fees.

-

As economic conditions worsen, consumers rely more heavily on credit cards than debit cards or cash.

-

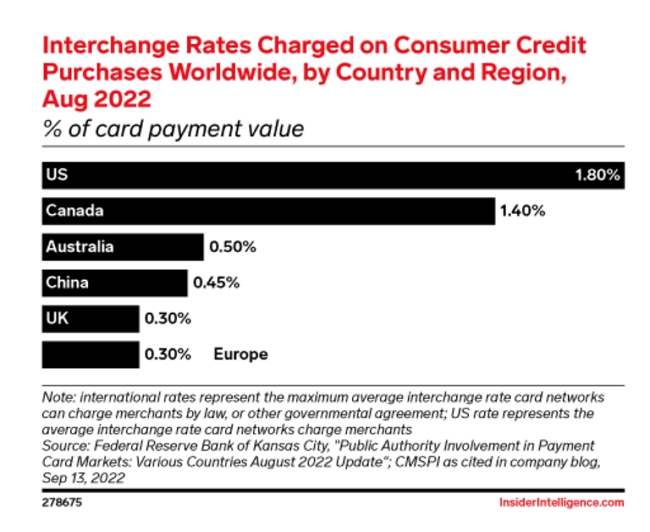

With Australian interchange fees already low, these increases will likely roll out here too.

-

Some merchants may see immediate impacts if they lack long-term contracts, locking in rates.

Coming at a Challenging Time

These fee hikes couldn't come at a worse time for small retailers already dealing with:

- High inflation driving up supply and operating expenses

- Households are now tightening their budgets

- Rising interest rates increase

This represents yet another margin squeeze small businesses did not need.

Strategies to Mitigate the Impact

While the situation seems bleak, retailers do have some options to minimise the damage:

-

Review Pricing - I know it is challenging due to market and competitive factors, but you need to review your prices

-

Renegotiate Rates - Use long-term contracts to lock in competitive credit card fees before the hikes hit. Investigate modern Credit Card solutions. The ones we suggest are UrPay and mx51. Let us know here and we will put you in contact with the correct people

-

Incentivise Debit card/Cash - Promote alternative payment methods like cash. Simply advertising that a small fee will be charged without money works well.

The bottom line is retailers should start reviewing the situation.