Today, not offering various payment alternatives will cost you. People want it. Yesterday, I went to buy bread partly to remove some change in my wallet; I went not to my regular bakery but to a bakery that I know accepts cash.

The Power of Flexible Payments

Catering to Customer Preferences

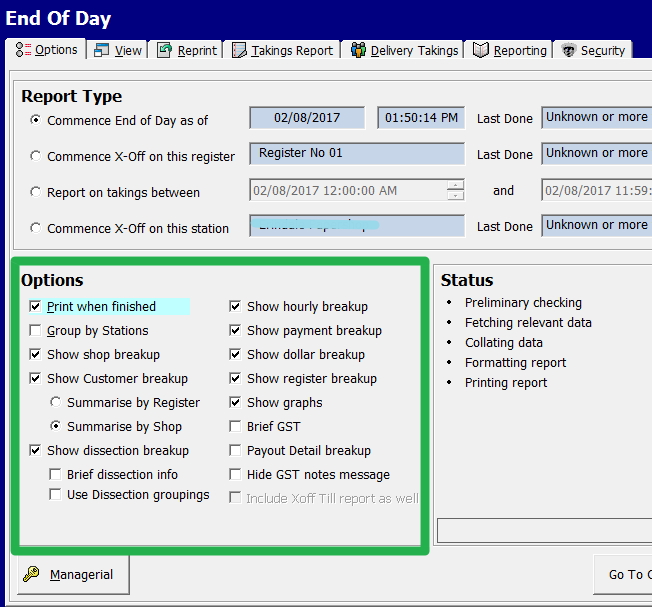

Our POS software features fully customisable payment methods.

Choose from cash, card, mobile payments, or bank deposits—whatever suits your customers' preferences.

This flexibility enhances customer satisfaction and keeps you competitive in Australia's evolving retail landscape.

Streamlining Transactions

An integrated POS system allows you to process payments faster and more accurately than traditional methods. This efficiency translates to shorter queues and happier customers.

Advanced Payment Handling

Split Payments and Deposits

Our POS solution goes beyond basic transactions. It allows for sophisticated payment scenarios that cater to various business models.

For instance, a customer ordering custom furniture can make a 50% advance payment, with the balance due upon delivery. This feature is handy for businesses dealing with high-value items or custom orders.

Customising Your Payment Rules

Tailor your POS system to match your unique business needs. Set minimum purchase amounts for card payments or configure automatic surcharges for specific payment methods.

Navigating Payment Method Restrictions

While customising your payment options, it's crucial to understand the legal framework governing payment methods in Australia. Unless you have a sign that you do not accept cash, you need a good excuse to reject it, e.g. you do not have enough change.

The Future of Retail Payments

COVID skyrocketed contactless payments. Most card payments now are contactless. Now, the convenience of tapping a card or device to pay speeds up the checkout process and enhances customer satisfaction by minimizing physical contact.

Security Benefits

What I like about contactless payments is their enhanced security features. Contactless technology provides a safer transaction environment by reducing the risk of card skimming and card security as you do not handle the card.

Mobile Wallet Usage

Mobile wallet usage is rapidly rising. These digital wallets give ease of use and enhanced security through biometric authentication, such as fingerprint or facial recognition. For example, I like that my fingerprint protects my card usage.

Choosing the Right POS System

When selecting a POS system for your retail business, consider these key factors:

- Integration capabilities with your existing systems

- Scalability to grow with your business

- User-friendly interface for quick staff training

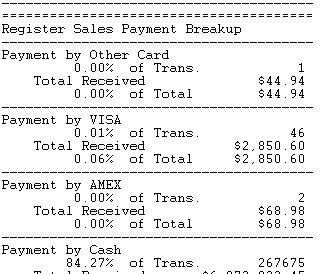

- Robust reporting features for business insights

- Regular updates and excellent customer support

The Impact on Your Bottom Line

Implementing comprehensive payments will have a significant impact on your business:

- Reduce transaction times

- Increase average transaction value; studies show people spend more on electronic money.

- Boost customer satisfaction scores with faster, more flexible payments in the form they like.

Ready to revolutionise your payment process?

Frequently Asked Questions (FAQ)

Q: How do contactless payments work?

A: Contactless payments use Near Field Communication (NFC) technology. This method is fast, secure, and reduces physical contact, making it a preferred option for many consumers.

Q: What are the benefits of using mobile wallets?

A: Mobile wallets offer several benefits, including convenience, speed, and enhanced security with biometric authentication.

Q: Are contactless payments secure?

A: Contactless payments are generally secure, I think more so than physical cards.

Q: What should I consider when choosing a POS system for my retail business?

A: When selecting a POS system, consider integration capabilities with existing systems, scalability to accommodate business growth, user-friendly interfaces for easy staff training, robust reporting features for business insights, and reliable customer support.

Q: How do POS systems handle split payments or deposits?

A: Our advanced POS systems allow businesses to manage complex payment scenarios such as split payments or deposits. This feature is handy for restaurants where customers often prefer split bills.

Q: Is tap-to-pay safe from skimmers?

A: Tap-to-pay transactions are generally safe from skimmers because they use encrypted data transmission and do not rely on the magnetic stripe that skimmers typically exploit. Mobile payment goes one stage further by adding an extra layer of security.