Barcodes against a QR Code

As Australian retailers modernise their operations, we strongly suggest you replace your barcode readers with 2D scanners that read QR codes. Upgrading to QR code readers, though with a minor hardware cost increase, provides notable benefits in data capacity, efficiency, and customer engagement, offering high ROI.

Enhanced Data Capacity and Versatility

The most significant advantage of QR codes is their superior data storage capacity. A standard barcode is sufficient only for a price or basic product code. In contrast, a QR code can hold over 4,200 alphanumeric characters. It contains a lot of text information that suppliers can use to store product specifications. We use it too for weighing items for the POS Systems.

Improved Scanning, Efficiency and Reliability

QR codes are engineered for superior performance in a fast-paced retail environment. Unlike traditional barcodes that need scanning in a straight line, two-dimensional QR codes can be read from any angle, so you don't have to line them up as much, which speeds up barcode reading significantly.

What I like about QR codes in particular is their better error-correction capability. I have seen them scanned even when the QR code is badly damaged, dirty, or obscured.

Streamlined Operations and Inventory Management

Because it has better error correction, it is much faster. There are far fewer attempts to read the barcode.

Industry pressure

QR codes are entering the market; we are now seeing products without barcodes, only with QR codes. If you want to handle such products, you need a scanner that reads QR codes, or you need to stick a barcode on each product.

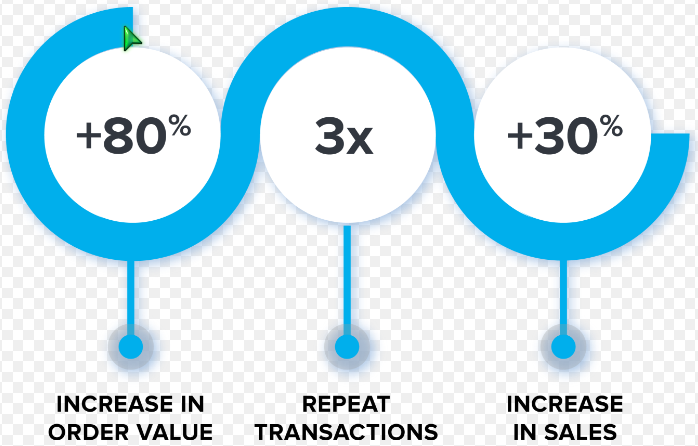

Loyalty programs

Our CRM can use QR codes. Many suppliers also use a QR code for the same reason.

Accessibility

QR codes are inherently accessible because suppliers favour them, as smartphones can easily scan them.

By adopting QR code readers, you are future-proofing your business.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.