Tip for getting paid faster

By reducing payment terms from 30 days to 7-14 days, businesses can significantly improve their cash flow. I suggest that you immediately change your POS System to do this.

The traditional 30-day payment system is a relic from our pre-digital past. Businesses then relied on paper invoices and the mail. As a result, these extended payment terms made practical sense. The 30-day terms accommodate the slow, manual payment process. Today, with electronic invoicing and point-of-sale (POS) software, these delays have been fixed. Most invoices and payments are now sent immediately electronically. Customers can pay within minutes of receiving the invoices. However, many still use outdated 30-day terms, unnecessarily delaying their payments.

This outdated approach creates serious financial consequences for businesses. Consider this example from a customer of ours who completed a rush job worth $4,000. They were expecting quick payment for the urgent work, yet on their invoice, their standard 30-day invoice terms gave the customer permission to wait the whole month. What should have been a few days stretched into two months of waiting.

When you offer 30-day terms, you're telling your customers to wait 30 days.

Today, Australian small businesses wait 22.6 days on average to receive payment. Invoices arrive 6.5 days late on average across all industries.

Setting Up Effective Payment Terms

Clear, standardised payment terms eliminate confusion and set proper expectations. Always specify the exact due date on every invoice using these standard business terms:

Net 7

Say "Payment due in 7 calendar days"

Net 14

Say "Payment due in 14 calendar days"

Net 30

Say "Payment due in 30 calendar days"

Due on Receipt

Say "Payment due immediately, now"

For most businesses, Net 7 or Net 14 terms work well. Reserve longer terms only for specific business relationships that require them.

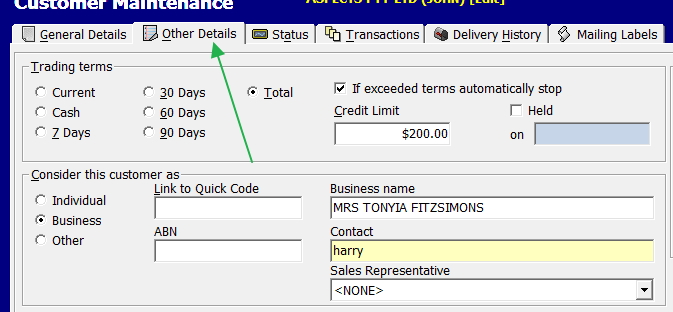

Customer-Specific Term Strategies

Analyse customer payment history to determine appropriate terms for different clients. Large customers often dictate their own payment terms as a condition of business. There's nothing you can do about that; no matter what they say, their accounting department works by the rules.

Use your POS System for Faster Payments

Set Net 7 or Net 14 as your standard terms for all new invoices. This automation ensures every invoice includes appropriate payment terms without requiring your manual intervention for each transaction.

Immediately send Invoices

Send your invoices immediately upon work completion. The sooner you send the invoice, the sooner your payment can come. If you take weeks to bill, then customers will take weeks to pay. Best to send invoices the same day you deliver products or complete services. With a computer, you do not need to batch invoices for weekly or monthly processing.

Utilise your customer balance reports

Use your POS system's ageing reports to identify overdue invoices and track payment delays. Do it systematically.

Offer Multiple Payment Methods

Provide customers with various convenient payment options:

- Credit and debit cards

- Direct bank transfer

- Online banking (include your BSB and account number)

- Digital payment platforms

Ensure they are clear, as you do not want any friction; eliminate reasons for customers to contact you for payment information.

Pre-Due Reminders

Send friendly reminders 2-3 days before payment deadlines. Include the specific due date to eliminate confusion. For example, specify "Payment due Wednesday, March 15th" rather than vague references like "in two days." On Monday, two days is Wednesday, on Wednesday it now means Friday.

Post-Due Follow-Up

Send follow-up reminders 3 days after due dates. Maintain a professional tone while clearly stating the overdue amount, and the payment is due NOW.

Personal Phone Contact

When these reminders fail to produce results, make direct phone calls. What I do is on the back of a printed invoice, I write notes immediately after the call with a date and time. I have had to use it once, and the judge accepted the notes as evidence.

Maximising Government Payment Speed with eInvoicing

Government departments are increasingly using an eInvoicing system. If you use it, it can dramatically accelerate payment processing. Contact relevant government departments to determine their terms for eInvoicing.

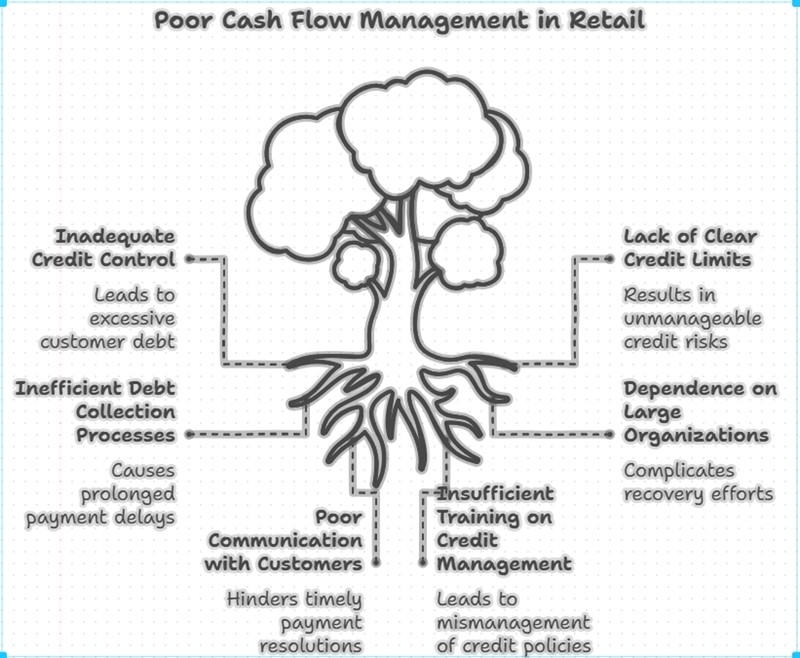

The Cash Flow Impact: Transform Your Business

The fact is that Cash flow problems cause more business failures than any other financial issue. Running out of working capital forces many profitable businesses to close.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.