Are EFTPOS and POS the Same?

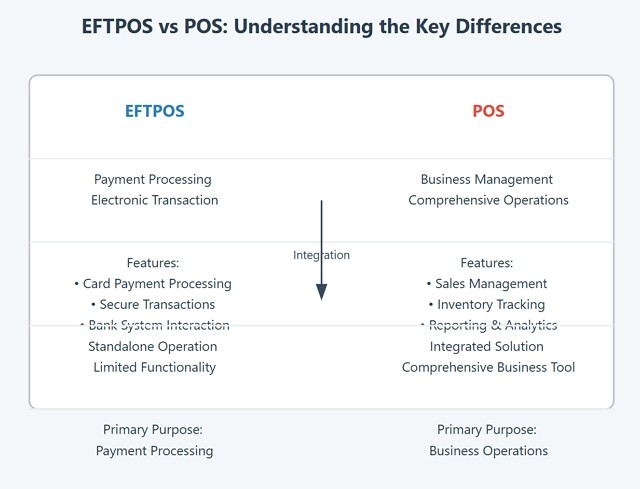

No, EFTPOS (Electronic Funds Transfer at Point of Sale) and POS (Point of Sale) are not the same, though they are commonly used together. EFTPOS refers to the payment processing method, while POS is a broader system containing sales tracking, inventory management, and other business functions. People often confuse EFTPOS and POS systems. This is mainly because salespeople try to confuse the issue by claiming that EFTPOS is POS. It is not.

What is EFTPOS

The bank system links the proposed transaction from your shop to the banking system. It usually operates through a terminal that allows customers to use their cards to complete an electronic payment using debit or credit cards.

The main features of EFTPOS terminals are:

- Secure payment processing

- Support for multiple payment methods (debit, credit, contactless)

- Encryption of payment data

What is a POS System?

It is the hardware and software used to run a shop.

Key features of POS systems include:

- Sales management and transaction processing

- Inventory tracking and management

- Customer relationship management (CRM)

- Reporting and analytics

How EFTPOS and POS Work Together

In modern retail POS Systems like ours, the EFTPOS terminals are often integrated into the Point of Sale Software. Here's how they typically work together:

- The POS system calculates the total sale amount.

- This amount is automatically sent to the EFTPOS terminal if integrated.

- The customer completes the payment on the EFTPOS terminal.

- The POS system gets a response from the EFTPOS terminal that the transaction has gone through.

- The POS System records the completed transaction.

This integration offers several benefits:

- Reduced manual data entry, minimising errors

- Faster checkout times, improving customer experience

- Simplified end-of-day reconciliation

- Real-time sales data for better business insights

Security Considerations

Both EFTPOS and POS systems must prioritise security to protect sensitive customer data. Integrating them makes them more secure.

Choosing the Right Solution for Your Business

A standalone EFTPOS terminal vs an integrated POS system

Faster

It's much faster, as the information exchange between the EFTPOS unit and the POS System is automatic.

Secure

Integrated systems mean that the merchant has an extra layer of security, as the POS Software and the EFTPOS are linked. The controls that enter the EFTPOS pass through the POS software checks first.

Fewer mistakes

People are in a hurry, and let's face it: almost everyone in retail is busy, so they make mistakes. POS Software makes fewer mistakes. For example, a person often misreads a one and a 7. Instead of $70 into the EFTPOS unit, they punch in $10. The retailer loses $60. Sometimes, this behaviour is not accidental; store attendants give discounts to relatives and friends.

Popular EFTPOS and POS Solutions in Australia

Our users can have various EFTPOS leading providers in the Australian market.

Conclusion

While EFTPOS terminals are for the payment processing only, an integrated POS system offers a comprehensive solution for managing your entire retail operation.

FAQs

Q: Can I use an EFTPOS terminal without a POS system?

A: Standalone EFTPOS terminals can process payments independently but won't offer inventory tracking or sales reporting features.

Q: How much does an integrated EFTPOS extra cost?

A: Costs vary depending on the EFTPOS providers. We do not charge for the integration.

Q: What's the difference between contactless payments via EFTPOS vs credit cards?

A: EFTPOS transactions through savings/cheque accounts usually have lower fees than credit card transactions processed via Visa or Mastercard networks.

Q: Are there any security risks in integrating EFTPOS with POS systems?

A: Overall integration will enhance security by reducing manual data entry; however, some intelligence is still needed to reduce the risks.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.