Retail today strives to maintain profitability. It has too. This is why gross margins are quoted. It is generally easy to calculate, often in theory, you do not have to as your suppliers will give them to you on request.

Actual gross margins, what you are getting is something else and challenging to get. Yet it is the heartbeat of your shop. It is the most important indicator to measure your business. It will help you see whether you are operating effectively.

It is, in my view, the best ways to determine whether your business position.

Now suppliers are often the first problem here as they often try to hide their figures. A common way to do this is not to give you margin but a markup figure. For example, a 30% margin is a 42% markup. Yet a 42% markup can sound better. Another way they often do this is to supply you with the margins for selected products only. Then they claim the others are of little relevance as they are minor. Yet to you, they may not be minor. It is, for this reason, we recommend that you always use margins for every product. That way, at least you are getting a consistent figure.

There are other reasons why actual gross margins are wrong. For example, if you have a product, you discount for some reason.

The result is the same, as your margins can differ from what it looks like in your mind. This is why you need a fast and reliable method to measure this KPI.

Well is quick and easy to do.

To get this KPI, please go to cash register reports, then go to sales.

Once there select

Dissection Sales / Profitability for a Given Period.

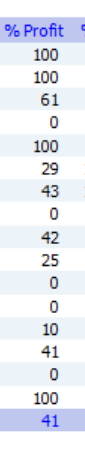

Now run the report for the last year. See is a column there which is % Profit, it will tell you the actual figure by dissection.

Now check them to see what you are getting.

Try it now, it will take you a second to do.