Recently, we negotiated excellent rates for Visa and EFTPOS transactions for our customers. Details are here.

Unfortunately, one of our competitors made some misleading comments in response to me on the time it takes for funds to be cleared into a merchant's account after a customer transaction. As this is an important issue, I will explain the process so you understand the problems, the big problem, and where people are being misled. I will use EFTPOS, but the situation is similar to MasterCard and VISA, although rarely as much of a problem.

As a rule, the people you deal with are often the agents for large financial companies who do the actual EFTPOS. These can be eftpos Payments Australia or huge multinational companies. For example, Fiserv, which I will discuss below, had approximately 44,000 employees worldwide on December 31, 2021, and works in 100 countries.

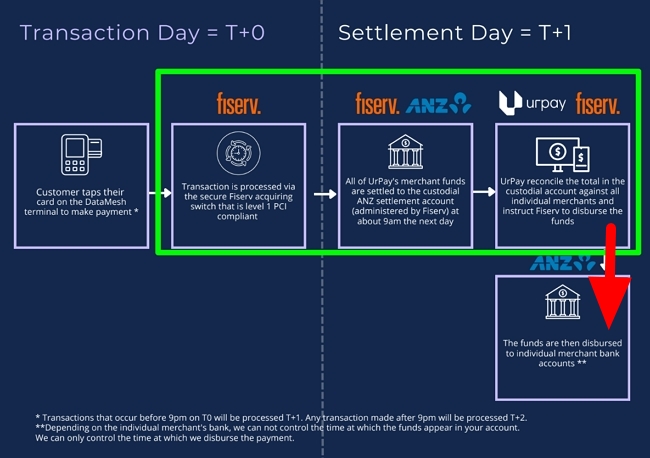

Now this image below will explain how it works generally.

In a typical EFTPOS transaction in Australia, the money flows through three main organisations:

- The customer's issuing bank

- The EFTPOS network's custodial settlement account

- The merchant's acquiring bank

There may also be other intermediaries involved.

The process happens in several steps:

1. The customer taps their card at the merchant's terminal, which is virtually instant.

2. The terminal requests authorisation from the acquiring bank, taking just seconds.

3. The acquiring bank authorises the transaction in seconds by checking with the issuing bank.

4. Authorisation is returned to the merchant terminal within seconds.

5. The transaction completes instantly from the merchant's perspective.

6. Funds are transferred into the EFTPOS network's custodial account, either same-day or next-day depending on cutoff times.

7. The EFTPOS network reconciles and okays the funds the next business day.

8. Finally, the funds are transferred from the custodial account to the merchant's bank account. This often takes 1-3 business days.

The delay in step 8 is a big problem, so I highlighted it and marked it with a red arrow above. It may take three days if the custodial and merchant accounts are with different banks.

Some people, as here, emphasise the fastest scenario as usual, e.g., quoting as if your bank account is the same as their custodial account, but I think this is often misleading.

Conclusion

You need to research and understand this settlement timeline when evaluating EFTPOS providers. Ask a detailed question to get the total elapsed time from the point of transaction to the money in your account to manage your cash flow appropriately. This can save you considerable frustration down the road.

"The customer taps and dashes, but your money may move at a snail's pace through the system."