From my last post here, I got some enquiries about charging customers for a lay-by.

Essentially legally, a lay-by is a payment option that allows customers to reserve a product. Then pay for it in instalments, typically over eight weeks. Security is the product only given to the customer after the total amount is paid. Lay-by has proved to be a convenient and popular method for people to buy expensive items. Now I am no lawyer, so I cannot advise you. I know what is being done now by some large department stores in Australia, who I am sure have checked it out. I also know what some clients do, and it works for them. So here it is.

As I discussed, lay-by also comes with problems for the retailer; let us discuss fees here.

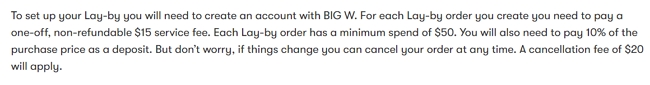

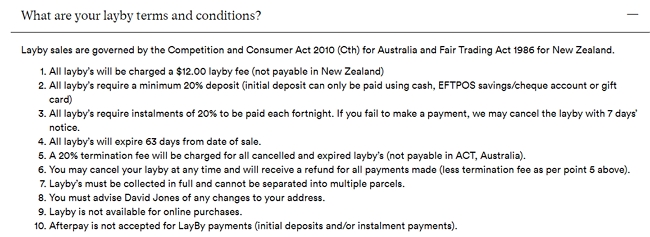

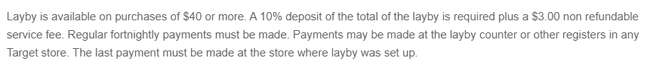

So there are the two main fees that retailers often charge. Doing a net search, I found some of the standard fees that large department stores charge for lay-by services from their websites:

So what we have

**Service fees**: These setup fees are for each lay-by for setting up and administering the lay-by agreement. Range in these majors from $3 to $15 per lay-by. These service fees are all non-refundable. Average out, we are looking at (3+10+15)/3= $9

**Cancellation charges**: These are fees that the retailer charges if, for some reason, the lay-by agreement is cancelled before making the final payment. Examples might be a customer changing their mind, the customer does not pay, or there is some other breach of terms by the customer. Cancellation charges vary widely from $0 for Target to $20 for K-Mart and 20% of the lay-by value for David Jones.

Now one point I want to stress here is that the Australian Competition and Consumer Commission (ACCC) states cancellation charges must be reasonable and reflect the actual costs incurred by the retailer. They are, however, quite flexible on what they consider a cost, e.g. salaries, storage, administration costs, and loss of opportunity to sell the product. If, for example, a customer ordered a Christmas item that was cancelled just before Christmas making it unsellable, then you have a good case in stating you have lost much of the value. Conversely, if it was a history book that you could sell anytime, you may find the ACCC may think 20% unreasonable. I suppose you could argue if it was a special order and you do not sell that type of book, you may have a hope of justifying 20% or more.

Determine your Layby Fees and Charges

1) This is all federal law. You may find in your state that there are state consumer laws you need to consider.

2) Before introducing charges, I would suggest doing what I did and looking at the terms and conditions that majors charge in your state.

3) Ask your industry body.

4) Determined your actual costs. Be honest with yourself. What does it cost you? If, for example, a person generally makes eight payments to pay a layby. They come into the shop eight times. Each visit means a hello, how are you, etc. The first would take 5 minutes to set up and explain the terms, then each visit takes 3 minutes, but the final to wrap it up takes 5 minutes. So we have about half an hour of work, plus some more administration work to look after the lay -by and this assumes everything goes right, and often, it does not. Here is a quick estimate, and if anyone wants to dispute it, I am happy to discuss it. Half an hour of work for a shop assistant is about $10, then add about 30% for extra cost sick pay, super, holiday etc. we have about $13. Forgetting the administration work, which should not be done. Salaries make up about half the expenses in a shop, so we can double them. So we are looking at costs for a first-level approximation of about $26. For that, you are getting $9. Now tell me, are my doubts about Lay-By vs BNPL unjustified? Plus, lay-by can be a legal minefield, something no one needs.

5) Then act accordingly.

POS Software

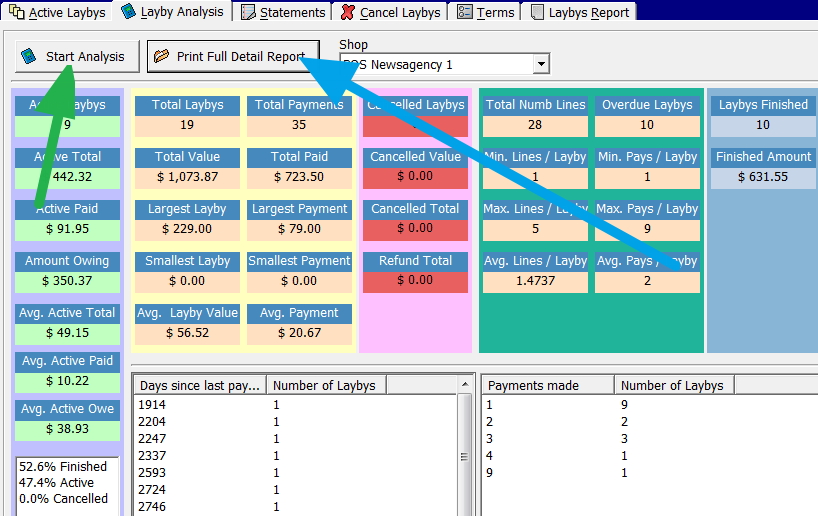

Finally, running lay-bys with reliable retail POS software would help you manage your lay-by transactions efficiently and accurately. You will not get better than ours. It does:

- Record and process lay-by payments

- Track inventory and stock levels

- Generate receipts and invoices

- Send reminders and notifications

- Produce detailed reports that give you insight into how it goes.

Here, for example, is an analysis of a shop's lay-bys you will find there marked with a green arrow. Then when you press it you will get pages of statistics.

If you press the blue arrow, you will get even more in a Full Detailed Report.

Final note

I hope this is useful. Let me know your thoughts.