With so much money coming through with EFTPOS and Credit cards into a shop, a reconciliation is crucial for managing a small business's finances. Once you do it, you can only then assess how often to do it.

How to do an EFTPOS and credit card transactions with your POS System.

Download Transaction Reports

Get detailed transaction reports from your EFTPOS and credit card provider. This will show all transactions that have gone through their systems for a certain period.

Go to your POS Reports

You need to export a report from your point of sale (POS) system showing all EFTPOS and credit card transactions recorded there.

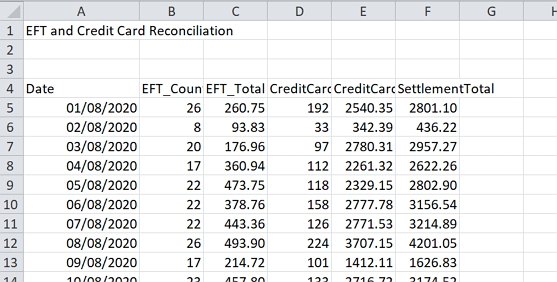

Cash register reports > Sales Register > EFTPOS and Credit Card Settlement (Excel)

If you do not have Excel. Get OpenOffice. It's free and good.

This will give you the transactions recorded in your POS by dates.

Reconciling transactions

Now comes the reconciliation part. Compare the amounts, dates and transaction numbers on the provider reports to the transactions in your POS report. Look closely for any discrepancies between the two.

One thing to remember is that transactions may show on different days between the reports. There will be a reason. What you tend to see is too few transactions on a day and then they appear shortly after. There is not much we can do about it, but you may want to take it up with your EFTPOS and credit card provider so you know why it is happening.

Use our Excel sheet as a Reconciliation Spreadsheet

Record your findings in a reconciliation spreadsheet. Document any discrepancies or issues you find. This creates an audit trail you can refer back to.

Resolve Discrepancies with Providers

If you find any concerning discrepancies, contact your EFTPOS or credit card provider to clarify and resolve them. Get them to confirm or correct any potential errors. Generally, they are helpful. Often you may have to wait a few days to get an answer. If a discrepancy can't be resolved, contact your accountant. Don't just leave an unexplained difference.

Transaction reconciliation

Based on feedback from your provider, make any adjustments needed in your POS and accounting records. Then complete reconciling your EFTPOS and credit card accounts.

Keep Records for ATO

You may sometimes need to keep reconciliation records for the ATO.

Reconcile Frequency

Decide how often you must reconcile. Frequent reconciliation makes it easier to pick up and query issues while details are still fresh, but it does add to the work. I would strongly suggest that monthly or quarterly is better than none. We do it monthly.

Reconciliation Provides Essential Financial Clarity

While reconciliation requires diligence but can be tremendously valuable for small business finances.

Let me know if you need other tips for streamlining your small business's EFTPOS and credit card reconciliation! I think you will find doing a reconciliation is well worth the effort if only for your peace of mind.