How Small Businesses Can Get Paid:

Introduction

As a small business owner, receiving payment promptly to maintain cash flow and ensure smooth operation is essential. Getting some of your customers to pay their bills on time can be challenging. Many need an account to deal with you; some are a problem. You can speed up payment and improve cash flow through a collect strategy.

In this blog post, we'll talk about ways to help small business owners get paid faster.

Debt Avoidance

Is it essential to offer debt to get the business?

By providing many payment options, you can avoid debt. You have many options, like credit cards, PayPal, and Afterpay.

Yes, they cost money, but bill collection is also expensive.

So transferring the responsibility for collection to someone else is a great way to improve customer satisfaction. It will also make doing business with you easier. By accepting various forms of payment, you can also attract a broader range of customers. This includes those who may need access to non-traditional payment methods.

Check to see that your customers aren't confused by your company's name:

Most people almost always review their debit and credit card statements. We've all heard about fraudulent transactions. So customers inquire about transactions with the bank if a merchant's name on their statement looks strange. Then the bank often cancels all these transactions and the affected card, resulting in an unnecessary argument. You might lose time and money as a result.

Check to see that your credit card's merchant name matches your company.

Choose your creditors.

Another crucial step is to choose only those to whom you provide debt. When you take on new customers, you should be cautious.

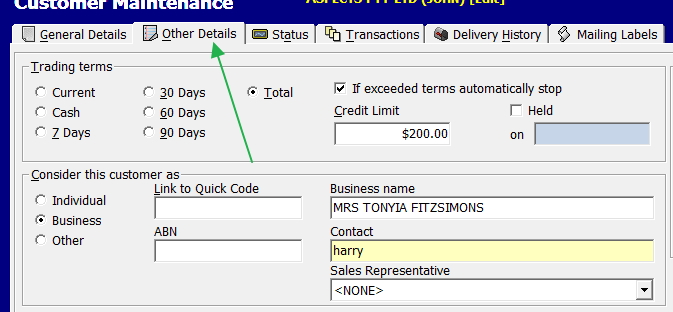

Set appropriate credit limits

Immediately on making a new customer, set up a credit limit. People should be given small credit limits and increase them over time.

If the debt exceeds a certain amount, management must decide. Our POS software will only allow purchases on the account to that credit limit. The account is then maxed. Then to trade, the customer must pay some of the debt, or you must make a management decision to increase the credit limit.

Select customer maintenance from the main menu in your system and then call a customer by clicking Other Details. ( See the green arrow below)

I want to go over two options with you.

You can set a credit limit for a certain amount of time. Majors have a big problem because they have money but take a long time to pay it back. In this case, you should give them a big credit limit, but be careful if they go over the limit.

The next choice is whether the operator should be notified so you can be notified or whether the account should be stopped if it exceeds the credit limit. The most cost-effective and efficient time to collect the debt is when the customer is in front of you and wants some goods.

Additionally, I recommend reviewing your credit limits annually.

Regularly check on outstanding debts.

You can only do something if you know what's going on.

At least once per month, look over any outstanding debts to ensure everything is on track. Try and spot any potential issues early. Many use it once a week.

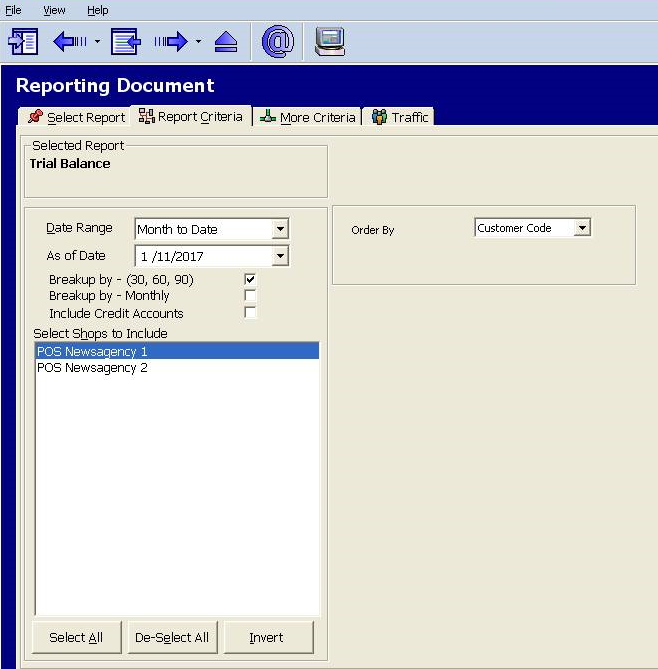

The client trial balance is one of the system's most important reports for many small businesses.

Registry Report>Client Trial Balance is where you'll find this report.

It shows the outstanding balance for each of your customers.

Looking at the image above, you'll like how you can select any date and see the values for that date to show you I put in a date years ago. This function is useful. This can be useful in talking to the debtor.

You can select the date range for the breakup, which is another excellent feature. The majority of people prefer weeks for individuals yet use months for businesses.

If you examine this image, you will notice that almost everything occurred within 90 days. It will be a red flag if it is actual data, not from four years ago.

Issue statements regularly

Your statements ought to be issued regularly. Your criteria used can be automatically set up.

Using the email option here can help you save both time and money. Details here

Communicate your payment terms clearly

To help ensure you are paid on time, clearly communicate your payment terms. Be open and honest about when payment is due and how much. Make it easy to pay by including all necessary information about all accepted payment methods on the statement.

Expressions like "the end of the month" are not as good as a specific date. If your terms are "end of the month" and the debt is in January, the end of the month is January 31, 2023. If the debt drags into February, it matures on February 28, 2023.

Consider settlement discounts

Consider giving customers or clients who pay on time incentives like discounts or loyalty programs. They might be more likely to prioritise repaying your company's debts.

Send regular payment requests.

A business asking for money that is owed is acceptable. Customers who still need to pay must be contacted—then given the information they need to pay and told when their payments are due.

This can be done automatically by our POS software.

You need to call if it gets worse.

Talking with the customer to find out why there is a payment issue is the best way to resolve the problem. Professionalism and politeness are essential. Avoid using obscene language or threatening customers with legal action. Instead, be friendly and professional when talking to customers and remind them how important it is to your business if they pay on time. Be understanding and respectful, and your chances of getting paid will increase.

I print an invoice on the back of the invoice and make a running journal on the back of the invoice. I write the date, time, who I spoke to and a description of what was said for each communication. I do not recommend writing it on a computer note electronically.

Do you still need to get paid?

Well, this customer eventually becomes a delinquent debtor.

It's essential to remember that sometimes it's better to take something than nothing and drop them as a customer. Give them to someone else to handle.

The debtor cannot pay.

You are now in trouble. It makes no difference what you do if they cannot pay. Only if they have it will you get your debt.

Consider negotiating a partial payment.

Debor won't pay.

Would you like to pursue it?

If the answer is "YES," then keep track of all attempts at payment and communication with customers or clients. As if you were going down this path, you need the proper paperwork. If it goes to a judge, everything needs to be documented.

It will be up to you to prove that you are entitled to these funds.

It's perilous. Don't think your case is a sure thing. It is impossible to predict how a case will progress. Law is so complicated. It is often erratic in execution; you do not know what they will say - consumers have rights too, and judges have their thoughts.

It would be best if you had a debt collector. They cost a lot.

You will also need a lot of time. The debt collector will contact the other party to clarify the situation, after which they will contact you to explain the situation. Preparation is required for the case; it takes time.

Then, bringing a case to court can take a long time. Besides, if the case is scheduled for today, but the court runs out of time today, you may be informed that they will reschedule it. You've lost a day; the court does not care.

Conclusion

Some important takeaways from this post are as follows:

> Using alternative payment methods

> Clearly stating your payment terms and deadlines

> Sending regular requests for payment

> Being selective about the customers you work with

> Offering your customers options

> Being willing to negotiate